Page 1 of 1

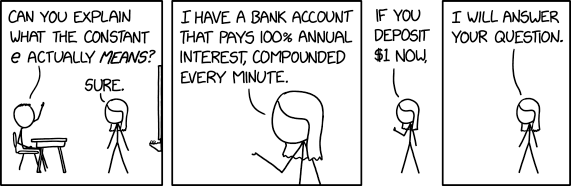

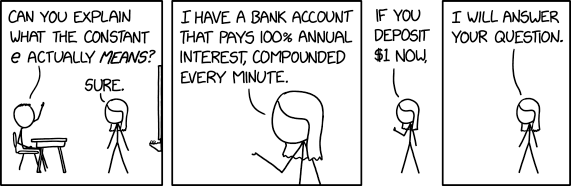

2768: "Definition of e"

Posted: Thu Apr 27, 2023 5:02 am

by chridd

Title text: Yeah, my math teacher back in high school set up the system to try to teach us something or other, but the 100% rate was unbelievably good, so I engineered a hostile takeover of his bank and now use it to make extra cash on the side.

If you put $1.00 into a bank that gives 100% annual interest compounded every minute, then at the end of the year you end up with $2.00, because

that's what 100% annual interest means! If putting 100% ÷ minutes per year as the per-minute interest rate into the formula gives $e instead, then dividing by minutes per year isn't how you calculate the per-minute interest rate! Why would you think you can calculate the interest rate like that, when it clearly gives the wrong answer?!?!‽

This has bothered me ever since my high school math class did this lesson.

Re: 2768: "Definition of e"

Posted: Thu Apr 27, 2023 1:02 pm

by LingEarth

chridd wrote: ↑Thu Apr 27, 2023 5:02 amIf you put $1.00 into a bank that gives 100% annual interest compounded every minute, then at the end of the year you end up with $2.00, because

that's what 100% annual interest means!

Except that's not what banks usually mean when they're talking about compound interest; see here:

https://en.wikipedia.org/wiki/Nominal_i ... erest_rate. "12% annual interest compounded monthly" really means you get 1% interest each month, thus something more than 12% at the end of the year. I agree it doesn't make sense, as it makes that "12%" figure meaningless, but, well, investors aren't mathematicians I guess.

Re: 2768: "Definition of e"

Posted: Thu Apr 27, 2023 4:16 pm

by chridd

Then banks are also using the wrong definition.

(…I'm still annoyed that my teacher just used this definition without any sort of justification or even acknowledgement that it's a weird definition. Do they expect high schoolers to all be familiar with the specifics of how banks do interest?)